The Sui blockchain has emerged as a powerful contender in the decentralized finance (DeFi) space, offering significant improvements in transaction speed, cost efficiency, and scalability. With total value locked (TVL) in Sui DeFi protocols increasing by 42% since the beginning of the year, this ecosystem is rapidly gaining traction among developers and users alike. This comprehensive guide explores everything you need to know about navigating the exciting world of DeFi on the Sui blockchain.

Understanding Sui Blockchain and Its Technical Advantages for DeFi

The Sui blockchain, developed by former Meta (Facebook) engineers, represents a significant evolution in blockchain technology. Built using the Move programming language, Sui introduces an object-centric model that fundamentally changes how blockchain transactions are processed and validated.

Core Technical Features

- Parallel Transaction Processing: Unlike traditional blockchains that process transactions sequentially, Sui can process unrelated transactions in parallel, dramatically increasing throughput.

- Horizontal Scalability: Sui’s architecture allows for linear scaling as more validators join the network, preventing bottlenecks during high demand.

- Low Transaction Fees: The efficient processing model keeps gas fees consistently low, making micro-transactions economically viable.

- High Throughput: Capable of processing thousands of transactions per second, Sui provides the speed necessary for real-time financial applications.

DeFi-Specific Advantages

- Object-Centric Model: Digital assets are represented as distinct objects that can be directly referenced and manipulated, simplifying complex DeFi operations.

- Immediate Transaction Finality: Transactions achieve finality in seconds, enabling rapid trading and liquidation processes essential for DeFi.

- Native On-Chain Orderbooks: Sui’s architecture efficiently supports on-chain orderbook systems, enabling more sophisticated trading mechanisms.

- Composability: DeFi protocols on Sui can seamlessly interact with each other, creating powerful combined functionalities.

The Move programming language, designed with financial applications in mind, provides built-in security features that help prevent common vulnerabilities found in other smart contract platforms, making it particularly suitable for DeFi applications.

Key DeFi Projects Built on the Sui Blockchain

The Sui DeFi ecosystem has been growing rapidly, with innovative projects spanning various financial services. Here’s an overview of the most significant protocols currently operating on the Sui blockchain:

Decentralized Exchanges (DEXs)

Cetus Protocol leads the Sui DEX space with its advanced AMM (Automated Market Maker) model and concentrated liquidity pools. With over $85 million in market cap, Cetus offers multi-token pools and low slippage trading.

DeepBook provides an on-chain central limit order book (CLOB) with over $383 million in market cap, enabling limit orders, market orders, and advanced trading features typically found on centralized exchanges.

Lending and Borrowing

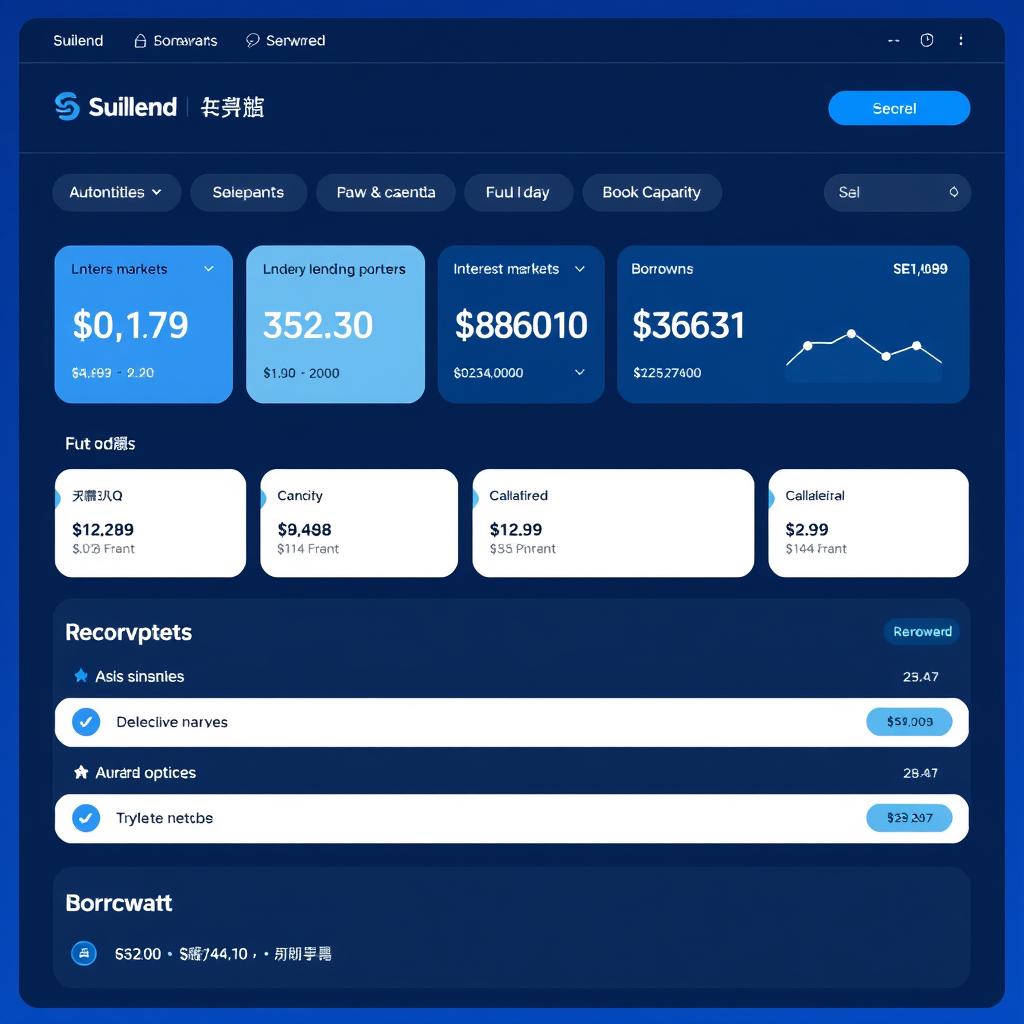

Suilend has emerged as a leading lending protocol with a market cap exceeding $39 million. Users can deposit assets as collateral to borrow other tokens, with algorithmically adjusted interest rates based on supply and demand.

Scallop offers a comprehensive money market protocol with isolated lending markets, allowing users to earn yield on deposits while maintaining risk separation between different asset classes.

Stablecoins and Synthetic Assets

Bucket Protocol issues BUCK, a decentralized stablecoin with a market cap of nearly $63 million. Users can mint BUCK by depositing collateral, maintaining the $1 peg through algorithmic mechanisms.

AUSD represents another significant stablecoin in the ecosystem with a market cap of over $197 million, providing essential liquidity for trading pairs and lending markets.

Yield Aggregators

FlowX Finance offers automated yield strategies that optimize returns across multiple DeFi protocols. With a market cap of $3.27 million, it automatically compounds rewards and rebalances positions to maximize yield.

Alpha Fi provides advanced yield farming strategies with a market cap exceeding $10.8 million, focusing on risk-adjusted returns through diversified yield sources.

Liquid Staking

Spring Staked SUI (SSUI) allows users to stake their SUI tokens while receiving liquid SSUI tokens that can be used throughout the DeFi ecosystem. With a market cap of nearly $31 million, it unlocks capital efficiency for staked assets.

xSUI offers another liquid staking solution with a market cap of $5.3 million, enabling users to earn staking rewards while maintaining liquidity.

Derivatives and Options

Bluefin provides a decentralized derivatives exchange with a market cap of $22.9 million, offering perpetual futures contracts with up to 20x leverage and advanced order types.

DoubleUp focuses on options trading with a market cap of $17.4 million, allowing users to hedge positions or speculate on price movements through decentralized options contracts.

Explore the Full Sui DeFi Ecosystem

Discover all 184+ tokens and projects building on the Sui blockchain, from established protocols to emerging innovations.

Sui DeFi vs. Other Blockchain Ecosystems: Comparative Analysis

When evaluating Sui blockchain DeFi against established ecosystems like Ethereum and emerging competitors like Solana, several key differences become apparent. This comparison helps users understand where Sui excels and where it still has room to grow.

| Feature | Sui | Ethereum | Solana |

| Transaction Speed (TPS) | 120,000+ | 15-30 (Layer 1) | 65,000+ |

| Average Transaction Fee | $0.0001-$0.001 | $1-$20+ | $0.0005-$0.002 |

| Transaction Finality | ~2 seconds | ~12 minutes | ~0.4 seconds |

| DeFi TVL (USD) | $564 million | $48+ billion | $3.8+ billion |

| Number of DeFi Protocols | 180+ | 4,000+ | 500+ |

| Programming Language | Move | Solidity | Rust |

| Consensus Mechanism | Proof of Stake (Narwhal & Bullshark) | Proof of Stake | Proof of History + Proof of Stake |

Key Advantages of Sui DeFi

- Superior Transaction Throughput: Sui’s parallel processing enables significantly higher transaction capacity than Ethereum, making it suitable for high-frequency trading and complex DeFi operations.

- Minimal Transaction Costs: With fees consistently below $0.001, Sui makes micro-transactions economically viable, opening possibilities for new DeFi use cases.

- Developer-Friendly Environment: The Move programming language provides built-in asset safety features that reduce the risk of common smart contract vulnerabilities.

- Innovative DeFi Primitives: Sui’s object-centric model enables novel DeFi mechanisms that aren’t possible or are inefficient on other blockchains.

- Growing Institutional Interest: Major financial entities like DeFi Technologies have accumulated significant SUI holdings, with assets under management reaching all-time highs of over $63.5 million.

- Rapid Ecosystem Growth: The 42% increase in TVL since the beginning of the year demonstrates accelerating adoption and development.

“Sui’s object-centric model and parallel execution create fundamentally new possibilities for DeFi applications that simply aren’t possible on traditional blockchains. We’re seeing innovations emerge that reimagine what’s possible in decentralized finance.”

Experience Sui’s Speed and Efficiency

Try a transaction on the Sui network to see the difference in speed and cost compared to other blockchains.

Challenges and Risks in the Sui DeFi Ecosystem

While Sui DeFi offers significant advantages, users should be aware of the challenges and risks inherent to this emerging ecosystem:

Strengths

- Technical architecture optimized for DeFi applications

- Growing developer ecosystem with strong funding

- Institutional backing and increasing adoption

- Innovative features enabled by the Move language

- Rapidly expanding TVL and user base

Challenges

- Relatively new blockchain with limited operational history

- Smaller liquidity pools compared to established chains

- Fewer battle-tested protocols and security audits

- Less decentralized validator set than mature networks

- Limited cross-chain infrastructure and bridges

Security Considerations

While the Move programming language offers enhanced security features, the relative newness of the Sui ecosystem means many protocols haven’t undergone the same level of security scrutiny as those on more established blockchains. Users should:

- Verify that protocols have undergone professional security audits

- Start with smaller amounts when trying new platforms

- Research the team and track record behind each project

- Monitor protocol TVL and user adoption trends

- Be cautious of extremely high APY offerings that may indicate unsustainable models

Risk Warning: DeFi investments carry significant risks including smart contract vulnerabilities, market volatility, liquidation risks, and impermanent loss. Never invest more than you can afford to lose, and diversify your DeFi portfolio across multiple protocols and blockchains.

Getting Started with Sui DeFi: A Step-by-Step Guide

Ready to explore the Sui DeFi ecosystem? Follow this comprehensive guide to set up your wallet, acquire tokens, and start interacting with protocols:

-

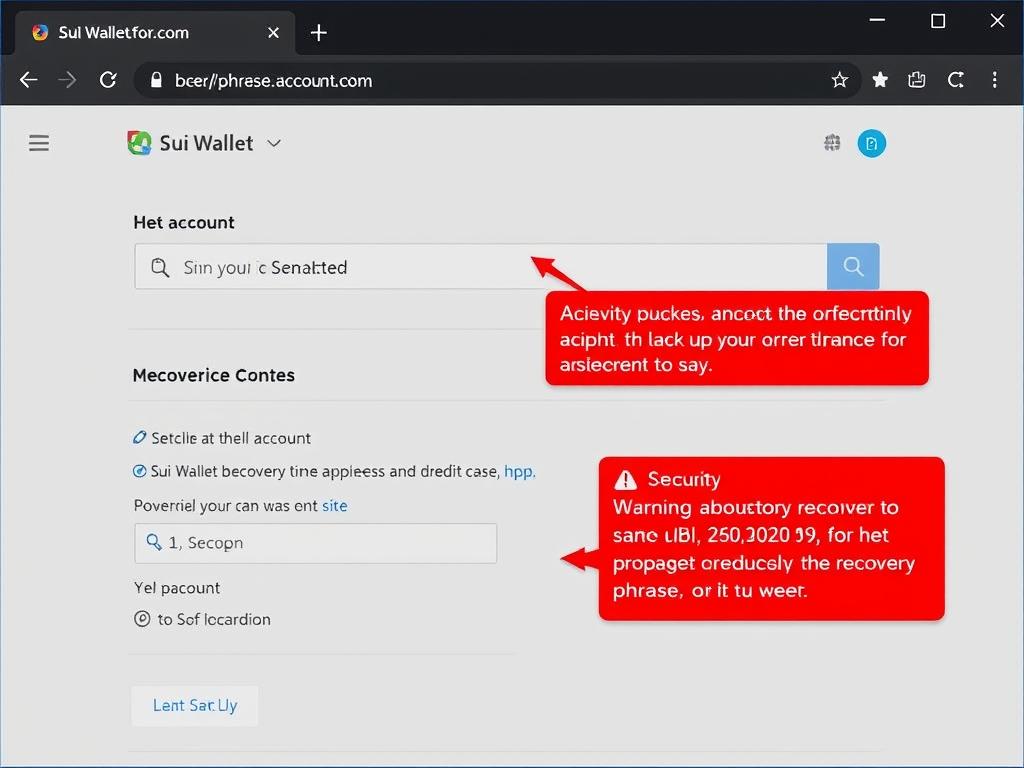

Set Up a Sui Wallet

Start by installing a Sui-compatible wallet. The official Sui Wallet browser extension provides a secure way to manage your assets and interact with DeFi applications.

- Visit the Sui Wallet download page

- Install the browser extension for Chrome, Firefox, or Brave

- Create a new wallet and securely store your recovery phrase

- Set a strong password for additional security

-

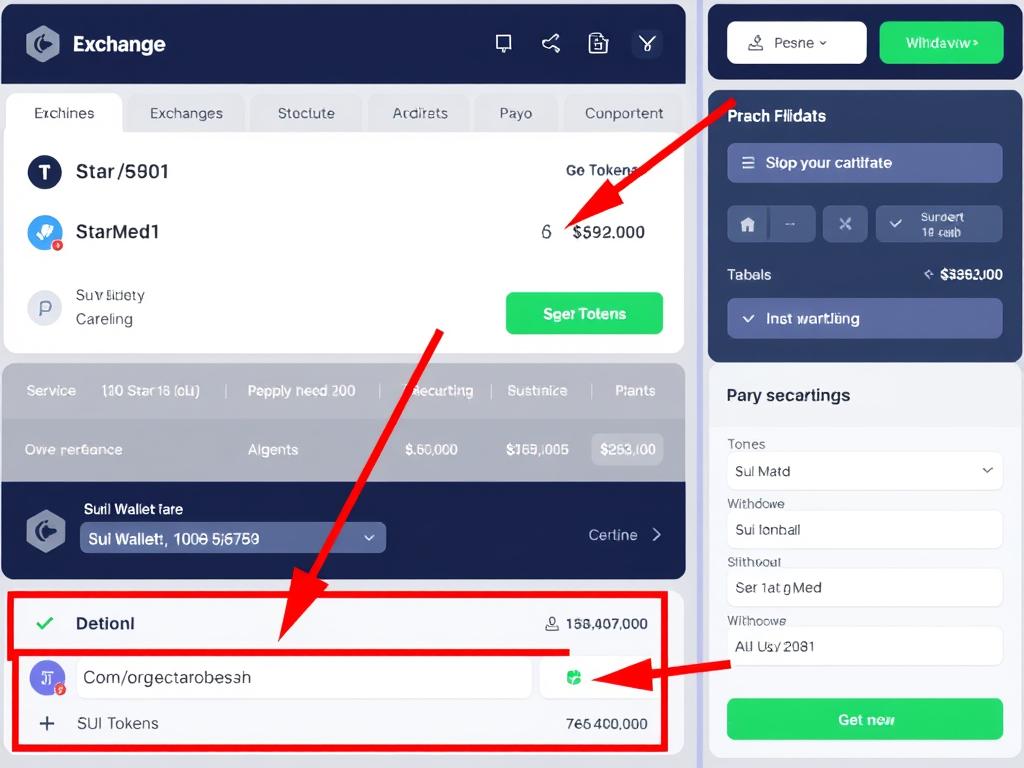

Acquire SUI Tokens

To interact with the Sui blockchain, you’ll need SUI tokens to pay for transaction fees and participate in DeFi protocols.

- Purchase SUI on major exchanges like Binance, Coinbase, or Kraken

- Withdraw your SUI tokens to your Sui Wallet address

- Alternatively, use a fiat on-ramp service that supports direct deposits to Sui

- For testing, you can get testnet SUI from the official faucet

-

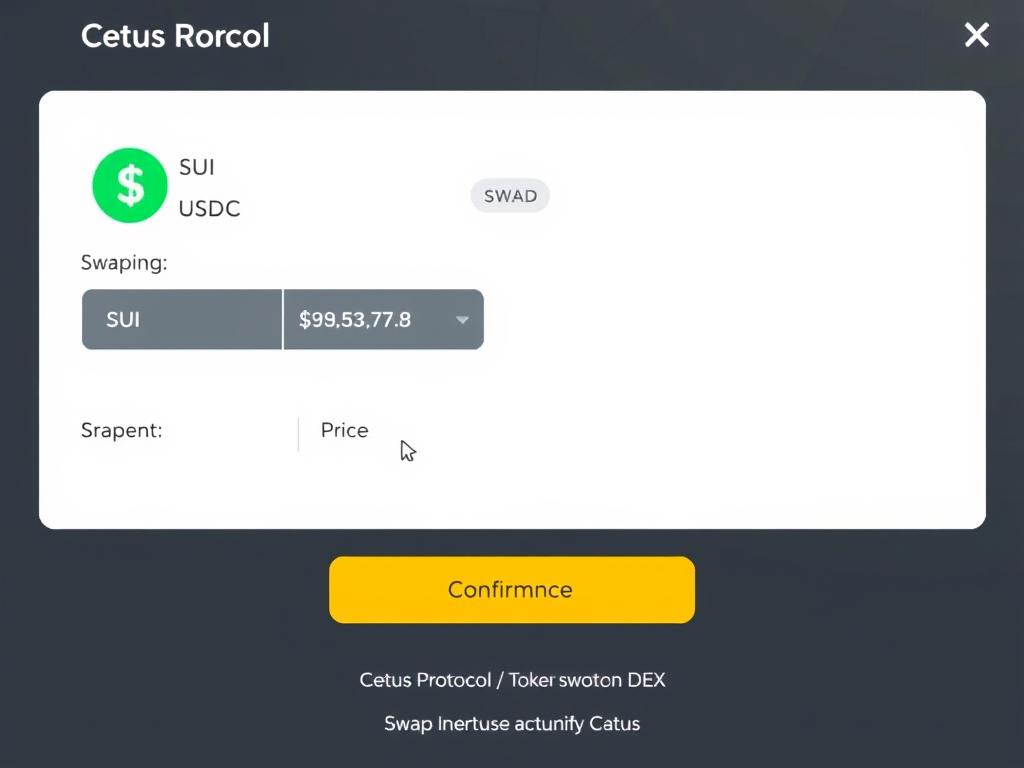

Swap Tokens on a DEX

Once you have SUI tokens, you can use a decentralized exchange to swap for other tokens in the ecosystem.

- Visit Cetus Protocol or another Sui DEX

- Connect your Sui Wallet to the platform

- Select the token pair you wish to trade (e.g., SUI to USDC)

- Enter the amount and confirm the transaction in your wallet

- Wait a few seconds for the transaction to complete

-

Provide Liquidity to Earn Yield

Contribute to liquidity pools to earn trading fees and potential token rewards.

- Navigate to the “Pool” or “Liquidity” section of the DEX

- Select a trading pair to provide liquidity for (e.g., SUI-USDC)

- Deposit equal values of both tokens into the pool

- Confirm the transaction and receive LP tokens representing your share

- Your LP tokens may be eligible for additional yield farming rewards

-

Stake Assets for Passive Income

Stake your SUI tokens or use liquid staking derivatives to earn staking rewards while maintaining liquidity.

- Visit a liquid staking protocol like Spring

- Connect your wallet and navigate to the staking section

- Enter the amount of SUI you wish to stake

- Receive SSUI or other liquid staking tokens in return

- Use these tokens in other DeFi protocols while earning staking rewards

Pro Tip: When first exploring Sui DeFi, start with small amounts to familiarize yourself with the ecosystem. As you gain confidence, gradually increase your exposure to different protocols and strategies.

Ready to Dive Into Sui DeFi?

Get started with your first Sui DeFi transaction by setting up a wallet and exploring the ecosystem.

Future Outlook: The Evolving Landscape of Sui DeFi

The Sui DeFi ecosystem continues to evolve rapidly, with several key developments on the horizon that could significantly impact its growth and adoption:

Upcoming Protocol Launches and Innovations

Real-World Asset (RWA) Tokenization

Several projects are developing frameworks for bringing real-world assets like real estate, commodities, and securities onto the Sui blockchain, potentially unlocking trillions in traditional asset markets for DeFi applications.

Advanced Derivatives and Synthetics

New protocols are building sophisticated derivatives platforms that will enable options trading, perpetual futures, and synthetic assets tracking traditional markets, expanding the financial instruments available to Sui users.

Institutional DeFi Solutions

Enterprise-grade DeFi protocols with enhanced compliance features are being developed to attract institutional capital, potentially bringing significant liquidity to the Sui ecosystem.

Strategic Partnerships and Integrations

The Sui Foundation and Mysten Labs have been actively forming partnerships to accelerate ecosystem growth:

- BTCFi Initiatives: Sui is positioning itself as a leading platform for Bitcoin DeFi (BTCFi) applications, with several projects building bridges to bring Bitcoin liquidity into the ecosystem.

- Financial Institution Collaborations: Companies like DeFi Technologies have made significant investments in Sui, with SUI becoming their second-largest holding after Bitcoin.

- Cross-Chain Infrastructure: Enhanced bridges and interoperability solutions are being developed to connect Sui with other major blockchains, expanding liquidity and use cases.

- Developer Grants Program: The Sui Foundation continues to fund innovative DeFi projects through its grants program, accelerating ecosystem development.

“The growth in Sui’s DeFi TVL, which has expanded by 42% since the year started, signals increasing developer and user confidence in the platform’s capabilities for building next-generation financial applications.”

Challenges and Opportunities Ahead

While the future looks promising for Sui DeFi, several challenges and opportunities will shape its trajectory:

Challenges

- Increasing competition from other high-performance Layer 1 blockchains

- Need for more comprehensive security auditing infrastructure

- Regulatory uncertainty surrounding DeFi globally

- Balancing decentralization with performance as the network grows

Opportunities

- Potential to capture market share from Ethereum due to lower costs

- Novel DeFi primitives enabled by Sui’s unique architecture

- Growing institutional interest in DeFi and blockchain technology

- Expansion into emerging markets where traditional finance is limited

As the ecosystem matures, we can expect to see increased standardization, improved user interfaces, and more sophisticated risk management tools that will make Sui DeFi more accessible to mainstream users and institutions alike.

Stay Updated on Sui DeFi Developments

Join the Sui community to receive the latest updates on new protocols, features, and opportunities in the ecosystem.

Conclusion: The Future of Finance on Sui

The rise of Sui DeFi represents a significant evolution in the decentralized finance landscape. With its technical advantages of parallel processing, low fees, and the security-focused Move programming language, Sui offers a compelling platform for building the next generation of financial applications.

While still in its early stages compared to Ethereum and other established ecosystems, Sui’s rapid growth in TVL and expanding protocol diversity demonstrate its potential to become a major player in the DeFi space. The unique object-centric model enables novel financial primitives that weren’t previously possible, opening new possibilities for innovation.

For users and developers looking to explore new frontiers in DeFi, the Sui blockchain offers an exciting combination of performance, security, and growing ecosystem support. As more protocols launch and liquidity increases, we can expect to see Sui continue its upward trajectory in the competitive landscape of decentralized finance.

Begin Your Sui DeFi Journey Today

Download the Sui Wallet, acquire some SUI tokens, and start exploring the innovative world of decentralized finance on the Sui blockchain.