Decentralized Finance (DeFi) is revolutionizing how we think about money, investments, and financial services. If you’ve been curious about this exciting frontier but felt overwhelmed by the technical jargon and complex processes, you’re not alone. This guide will walk you through the fundamentals of DeFi, with a special focus on Scallop—an innovative lending protocol built on the Sui blockchain that’s making waves in the crypto community.

Whether you’re looking to earn interest on your digital assets, explore new investment opportunities, or simply understand what all the buzz is about, this beginner-friendly introduction will equip you with the knowledge and confidence to take your first steps into the world of decentralized finance.

Understanding DeFi: The Banking System Without Banks

Decentralized finance (DeFi) represents a fundamental shift in how financial services operate. Unlike traditional finance, which relies on intermediaries like banks and brokerages, DeFi uses blockchain technology and smart contracts to create financial services that operate without middlemen.

Think of DeFi as a financial ecosystem built on digital building blocks. Each block—whether it’s a lending protocol, exchange, or investment platform—can connect with others to create sophisticated financial services that are:

“DeFi is like having a financial system that’s open 24/7, accessible to everyone, and doesn’t require permission from gatekeepers to use.”

For beginners, the easiest way to understand DeFi is to compare it to familiar financial services. Your neighborhood bank takes deposits and loans that money to others, keeping the difference in interest as profit. In DeFi, protocols like Scallop perform the same function, but instead of profits going to bank shareholders, they flow to the users who provide liquidity to the system.

Popular DeFi Examples: Beyond Just Scallop

The DeFi ecosystem encompasses various types of financial services, each serving different needs. Here are some key categories and examples:

Lending Protocols

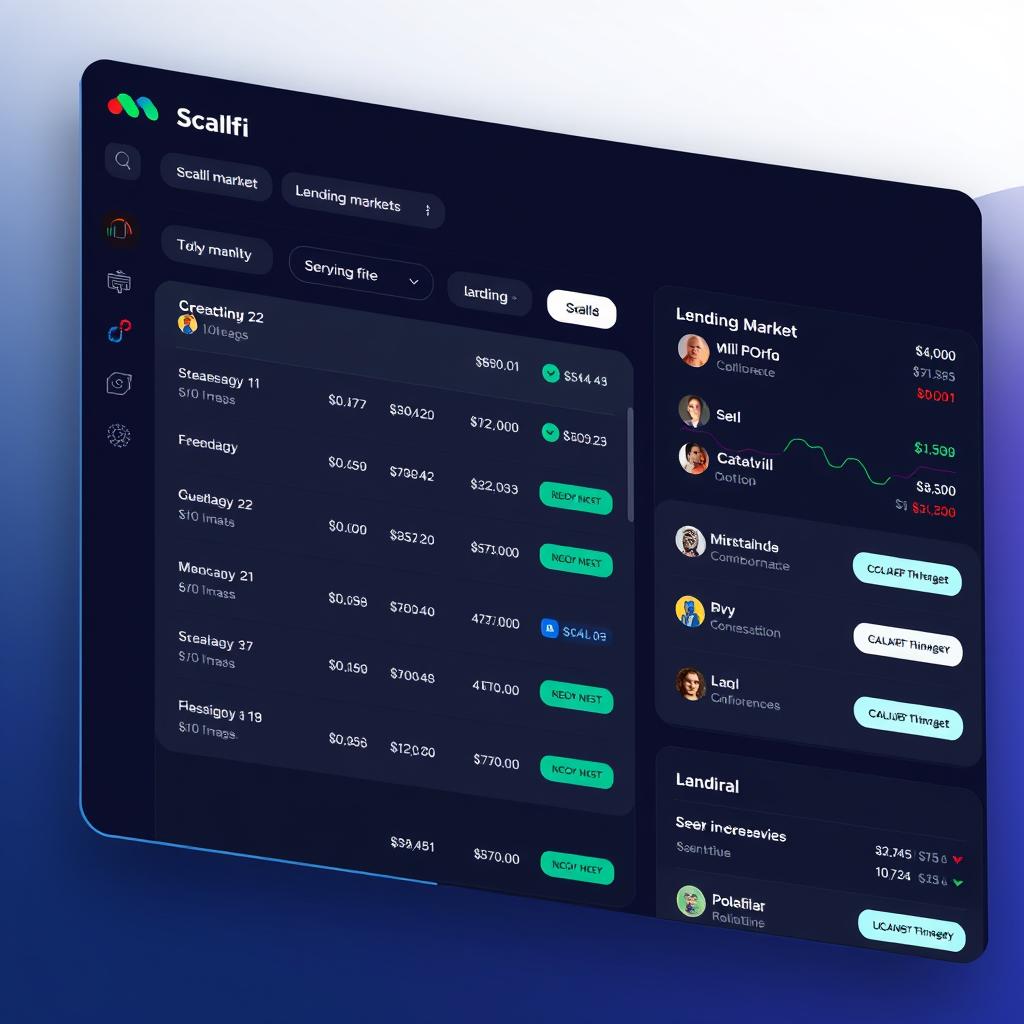

Scallop on Sui blockchain allows users to lend their crypto assets and earn interest or borrow against their holdings. As the first DeFi project to receive an official grant from the Sui Foundation, Scallop offers institutional-grade lending services with enhanced security features.

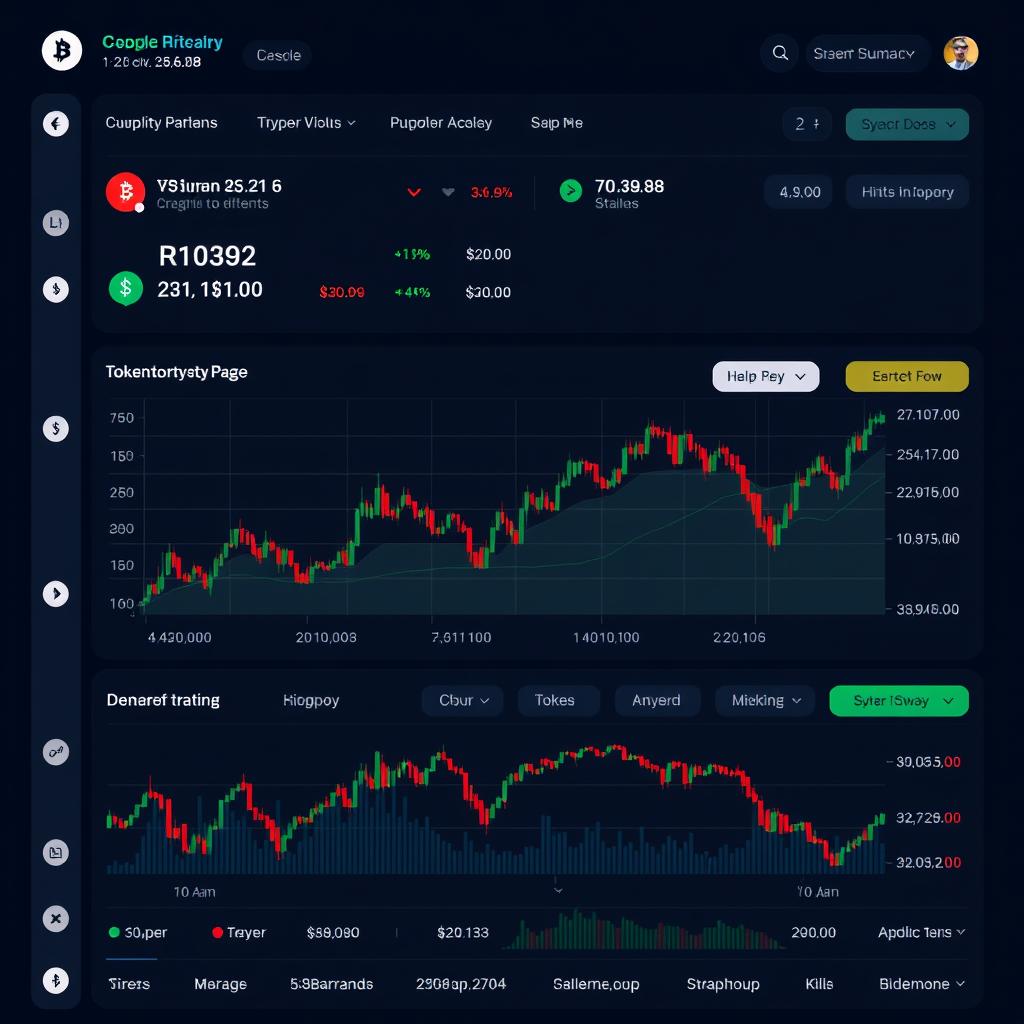

Decentralized Exchanges (DEXs)

DEXs like Aftermath Finance on Sui allow users to trade cryptocurrencies directly without intermediaries. They use automated market makers (AMMs) and liquidity pools to facilitate trades, often with lower fees than centralized exchanges.

Yield Farming Platforms

Yield farming platforms allow users to earn additional tokens by providing liquidity to various protocols. These platforms often offer complex strategies to maximize returns through a combination of lending, borrowing, and staking.

Stablecoins

Stablecoins like USDC and USDT (both supported by Scallop) are cryptocurrencies designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. They provide a way to escape crypto volatility while still accessing DeFi services.

Insurance Protocols

DeFi insurance protocols offer coverage against smart contract failures, hacks, or other risks associated with using DeFi platforms. These services help mitigate some of the risks inherent in the emerging DeFi ecosystem.

Liquid Staking Derivatives

Liquid staking derivatives (LSDFi) like Scallop’s sCoin system allow users to stake their assets while receiving a liquid token (like sSUI) that represents their staked position. These tokens can be used in other DeFi applications while still earning staking rewards.

Ready to Explore DeFi Applications?

Start your journey with trusted protocols that prioritize security and user experience.

How to Invest in DeFi: Step-by-Step Guide

Getting started with DeFi might seem daunting, but breaking it down into manageable steps makes the process much more approachable. Here’s how to begin your DeFi journey with a focus on using the Scallop protocol on Sui blockchain:

Set Up a Compatible Wallet

Your first step is to create a crypto wallet that supports the Sui blockchain. The Sui wallet or OKX Wallet are excellent choices for interacting with Scallop.

Get started with a secure wallet that supports the Sui blockchain:

Acquire SUI and Stablecoins

To use Scallop, you’ll need SUI (the native token of the Sui blockchain) for transaction fees and either SUI or stablecoins like USDC to deposit or use as collateral.

You can purchase these on centralized exchanges like Binance or Bitrue, then transfer them to your Sui wallet. Alternatively, use decentralized exchanges on Sui like Aftermath Finance to swap tokens.

Connect to Scallop Protocol

Visit the Scallop website and connect your wallet by clicking “Connect Wallet” and following the prompts. Once connected, you’ll have access to all of Scallop’s features.

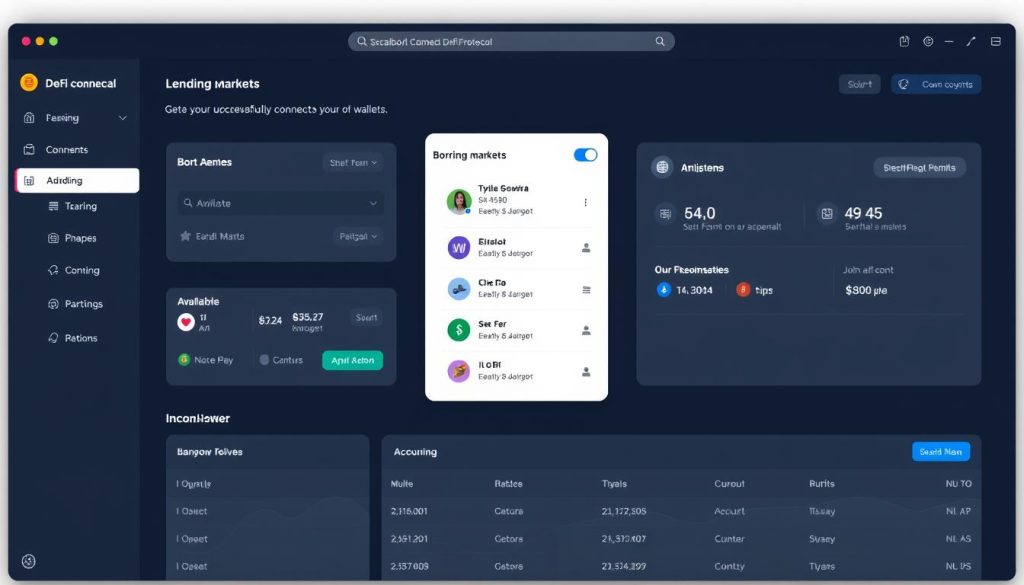

Deposit Assets to Start Earning

Navigate to the “Supply” section and select the asset you wish to deposit. When you deposit assets into Scallop’s lending pools, you’ll receive sCoins (like sSUI or sUSDC) that represent your deposit and automatically accrue interest over time.

Explore Borrowing (Optional)

If you want to borrow against your deposited assets, go to the “Borrow” section. Remember that you’ll need to maintain sufficient collateral to avoid liquidation. Scallop uses a dynamic interest rate model that adjusts based on supply and demand.

Essential DeFi Tools and Apps

Wallets

Portfolio Trackers

Understanding DeFi Tokens

DeFi tokens like Scallop’s SCA serve multiple purposes within their ecosystems:

| Token Type | Function | Example in Scallop |

| Governance Tokens | Allow holders to vote on protocol changes | SCA can be locked to create veSCA for voting rights |

| Utility Tokens | Provide access to specific protocol features | SCA offers fee discounts and boosted rewards |

| Liquidity Tokens | Represent deposits in lending or liquidity pools | sCoins (sSUI, sUSDC) represent deposits and accrue interest |

Ready to Start Your DeFi Journey?

Begin with a small deposit to experience how DeFi works firsthand.

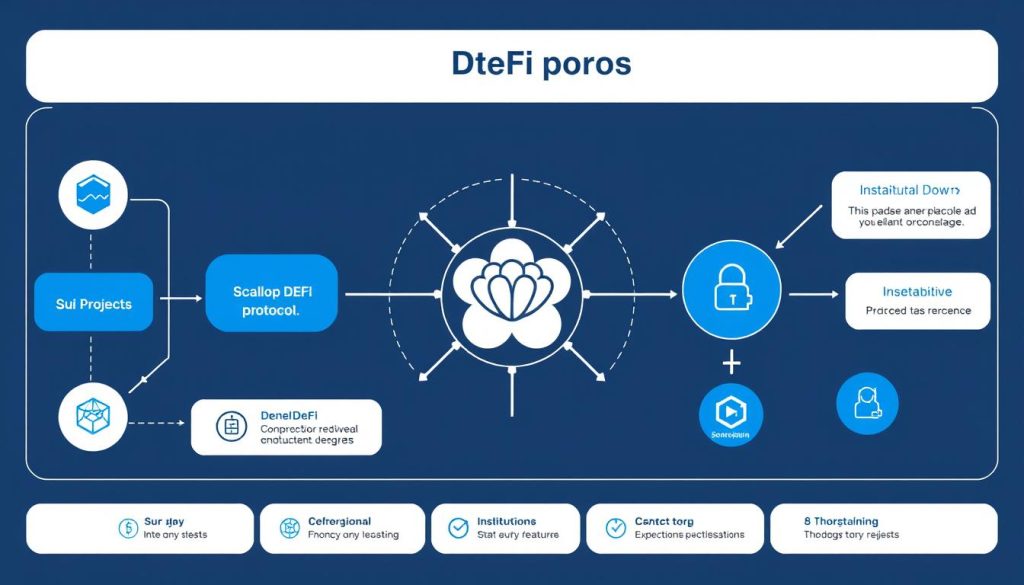

Spotlight on Scallop: The Institutional-Grade DeFi Protocol on Sui

Scallop stands out in the DeFi landscape as a next-generation protocol built specifically for the Sui blockchain. As the first DeFi project to receive an official grant from the Sui Foundation, Scallop has established itself as a cornerstone of the Sui ecosystem.

How Scallop Works

At its core, Scallop is a money market protocol that enables users to lend and borrow crypto assets. Here’s what makes it unique:

Unique Advantages of Scallop

Advantages

- Built on Sui’s high-performance blockchain (10,000+ TPS)

- Institutional-grade security with multiple audits

- First-mover advantage in the Sui ecosystem

- Enhanced composability with other Sui protocols

- Low transaction fees (as little as $0.0001)

Considerations

- Relatively new protocol (launched in 2024)

- Sui ecosystem still developing compared to Ethereum

- Market volatility can affect collateral values

- Learning curve for DeFi beginners

Risks and Rewards

| Potential Rewards | Associated Risks | Risk Mitigation |

| Earning interest on deposits (3.8-21.5% APY on SUI) | Smart contract vulnerabilities | Multiple security audits by Zellic, OtterSec, and MoveBit |

| Leveraging assets through borrowing | Liquidation if collateral value drops | Conservative borrowing and monitoring positions |

| Governance participation via veSCA | Token price volatility | Dollar-cost averaging and long-term perspective |

| Advanced trading strategies via flash loans | Complex execution risks | Start with simple strategies and small amounts |

Getting Started with DeFi: Your Next Steps

Decentralized finance represents a significant evolution in how we interact with financial services, and protocols like Scallop on the Sui blockchain are making these innovations more accessible than ever before.

Start Small and Learn: The best way to understand DeFi is to experience it firsthand. Begin with a small amount that you’re comfortable with—perhaps just $50-100 in SUI or USDC—and deposit it into Scallop to see how the lending process works.

As you grow more comfortable with the basics, you can explore more complex strategies like borrowing against your deposits or providing liquidity to earn additional rewards. Remember that DeFi is still an evolving space, so continuous learning is key to navigating it successfully.

Is DeFi safe for beginners?

DeFi carries risks like any investment, but you can minimize them by starting with established protocols like Scallop that have undergone security audits, using only funds you can afford to lose, and taking time to understand how each protocol works before committing significant capital.

How much can I earn through Scallop lending?

Interest rates on Scallop vary based on market conditions and the specific asset. As of May 2025, lending rates for SUI range from 3.8% to 21.5% APY, while stablecoins like USDC typically offer more stable but lower rates. These rates adjust dynamically based on supply and demand.

Do I need technical knowledge to use DeFi platforms?

While some technical familiarity helps, platforms like Scallop are designed with user-friendly interfaces that make basic functions like depositing and borrowing accessible to beginners. As you gain experience, you can explore more advanced features.

Ready to Experience DeFi on Sui Blockchain?

Start your journey with Scallop today and discover the potential of decentralized finance.