The decentralized finance landscape continues to evolve rapidly, with innovative lending protocols emerging across various blockchains. Among these rising stars, Scallop on the Sui blockchain is positioning itself as one of the best DeFi lending platforms of 2025. This comprehensive analysis explores how Scallop’s unique features, robust security measures, and seamless ecosystem integration are setting new standards for DeFi lending protocols in an increasingly competitive market.

What is Scallop: The Next Generation DeFi Lending Protocol

Scallop is a decentralized lending and borrowing protocol built natively on the Sui blockchain. Launched in 2023, it has quickly established itself as a frontrunner in the DeFi lending space by leveraging Sui’s unique architecture to deliver enhanced performance, security, and user experience. Unlike traditional financial institutions that require extensive paperwork and credit checks, Scallop enables anyone with crypto assets to participate in lending markets or access loans through over-collateralization.

As a DeFi lending protocol, Scallop operates entirely through smart contracts, eliminating intermediaries and creating a trustless environment where users maintain control of their assets until transactions are executed. This approach aligns with the core principles of decentralized finance while addressing many of the limitations found in earlier lending platforms.

“Scallop represents the next evolution in DeFi lending by combining Sui’s powerful infrastructure with innovative financial mechanisms, creating a platform that’s both accessible to newcomers and sophisticated enough for experienced DeFi users.”

The protocol’s native integration with the Sui blockchain provides significant advantages in terms of transaction speed, gas efficiency, and scalability compared to platforms built on more congested networks. These technical foundations enable Scallop to offer a more responsive and cost-effective lending experience than many traditional savings accounts or competing DeFi protocols.

Key Criteria for Evaluating the Best DeFi Lending Platform

When assessing what makes the best DeFi lending platform, three critical factors stand out: collateral options, interest rate models, and ecosystem integration. Let’s examine how Scallop performs against these benchmarks compared to other leading lending protocols.

1. Collateral Options: Flexibility Meets Security

The variety and quality of accepted collateral significantly impact a lending platform’s utility and risk profile. Scallop has implemented a thoughtfully designed collateral system that balances accessibility with risk management.

Supported Assets

Scallop currently supports a diverse range of assets as collateral, including:

- SUI (Sui’s native token)

- USDC and USDT (major stablecoins)

- wETH and wBTC (wrapped versions of major cryptocurrencies)

- Key Sui ecosystem tokens

This selection provides users with flexibility while maintaining the protocol’s stability through careful risk assessment of each asset. Compared to other lending protocols that may only support a handful of major cryptocurrencies, Scallop’s approach allows for greater portfolio diversification.

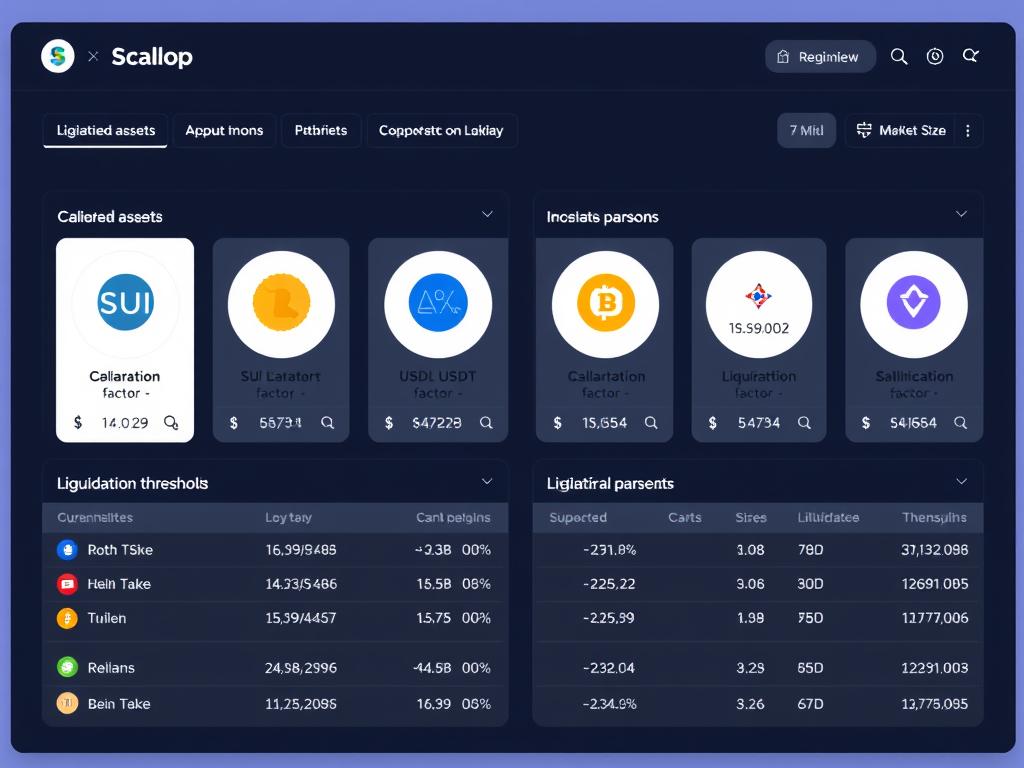

Collateralization Ratios

Scallop implements dynamic collateralization ratios based on asset volatility and liquidity. For example:

| Asset | Collateral Factor | Liquidation Threshold | Liquidation Penalty |

| SUI | 70% | 80% | 5% |

| USDC/USDT | 85% | 90% | 3% |

| wETH | 75% | 85% | 5% |

| wBTC | 75% | 85% | 5% |

These ratios are more competitive than many other DeFi lending protocols, which typically offer lower collateral factors, especially for volatile assets. Scallop’s approach to collateral management demonstrates a sophisticated understanding of risk while maximizing capital efficiency for users.

Ready to Leverage Your Crypto Assets?

Explore Scallop’s flexible collateral options and start earning interest on your idle crypto or access liquidity without selling your assets.

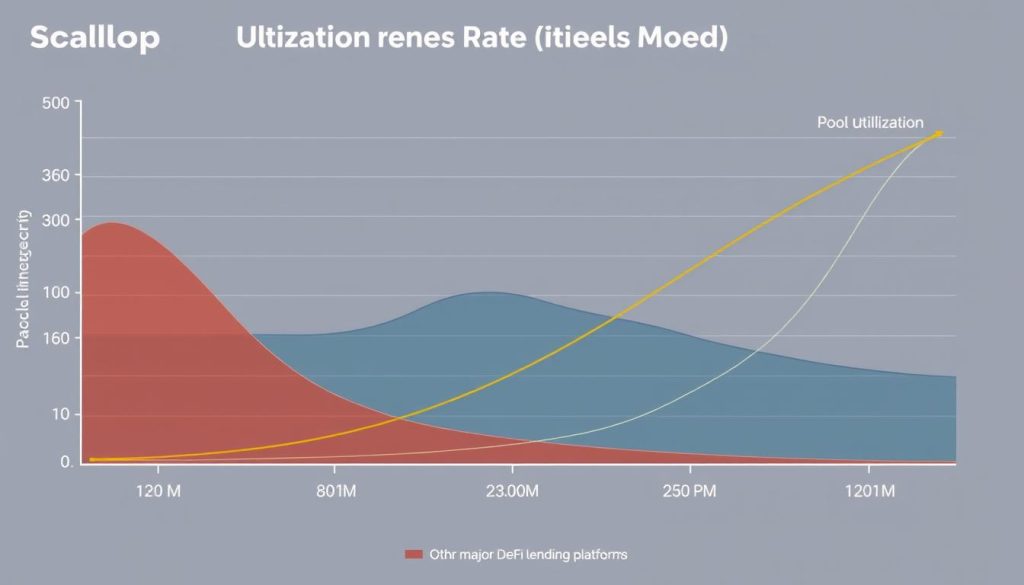

2. Interest Rate Models: Balancing Supply and Demand

A sophisticated interest rate model is crucial for any lending platform’s sustainability and attractiveness to users. Scallop has implemented an advanced algorithmic approach that responds dynamically to market conditions.

Utilization-Based Rates

Scallop employs a utilization-based interest rate model that automatically adjusts based on the supply and demand dynamics within each lending pool. This approach:

- Increases borrowing rates as pool utilization rises, incentivizing more deposits

- Decreases rates when utilization is low, encouraging borrowing

- Includes kink points where rates accelerate more rapidly to prevent 100% utilization

This model ensures that interest rates remain competitive while maintaining liquidity in the protocol. For lenders, this means potentially higher yields during periods of high borrowing demand compared to traditional savings accounts.

Current Lending Rates

| Asset | Supply APY | Borrow APY | Utilization |

| SUI | 3.5-7.2% | 5.8-12.4% | 62% |

| USDC | 5.2-9.8% | 7.5-15.2% | 78% |

| USDT | 5.1-9.5% | 7.3-14.8% | 76% |

| wETH | 2.8-6.5% | 4.9-11.2% | 58% |

Compared to other leading DeFi lending protocols, Scallop consistently offers competitive rates, particularly for stablecoins. This makes it an attractive option for yield-seeking users looking to maximize returns on their crypto assets.

3. Sui Ecosystem Integration: Native Advantages

A lending platform’s integration with its underlying blockchain ecosystem significantly impacts its utility, efficiency, and growth potential. Scallop’s native development on Sui provides several distinct advantages.

Technical Integration

Scallop leverages Sui’s unique technical capabilities, including:

- Parallel transaction execution for higher throughput

- Object-centric data model for more efficient asset management

- Sui Move language for safer smart contracts with fewer vulnerabilities

- Horizontal scalability that grows with user demand

These technical advantages translate to a more responsive user experience with faster transaction confirmations and lower gas fees compared to lending platforms on more congested blockchains.

Ecosystem Partnerships

Scallop has established strategic partnerships within the Sui ecosystem, creating a seamless experience for users:

Sui Wallets

Direct integration with Sui Wallet, Ethos Wallet, and other ecosystem wallets for one-click lending and borrowing.

DEXs & Liquidity

Partnerships with leading Sui DEXs for efficient liquidations and optimized swap routes when managing collateral.

Yield Aggregators

Collaboration with yield optimization protocols to maximize returns for lenders through automated strategies.

This ecosystem integration creates a flywheel effect, where each partnership enhances Scallop’s utility and attracts more users to the platform, further strengthening its position as one of the best DeFi lending platforms in the Sui ecosystem.

Experience the Sui Advantage

Discover how Scallop’s native integration with the Sui blockchain delivers faster transactions, lower fees, and enhanced security for your lending and borrowing activities.

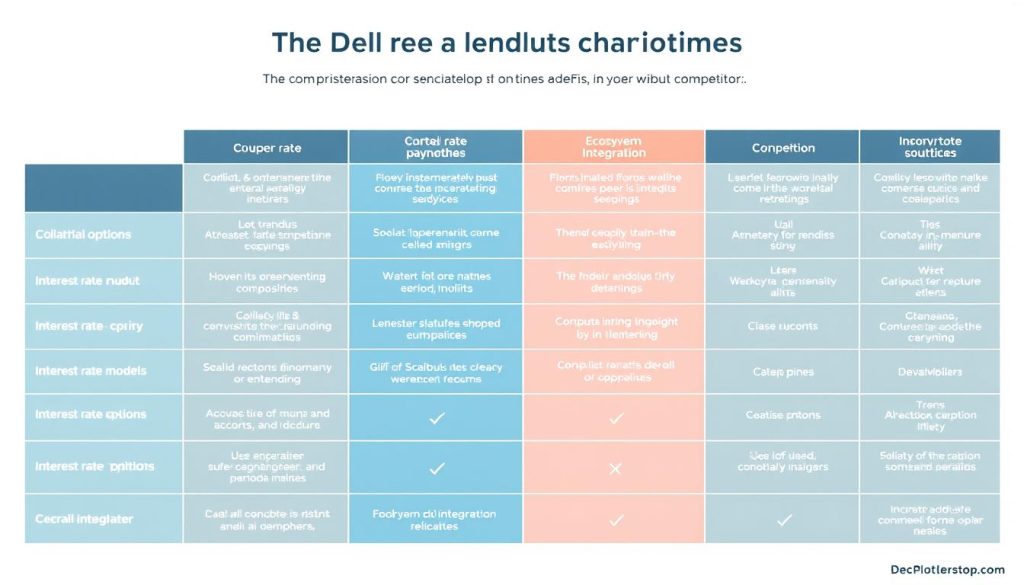

How Scallop Compares to Other Leading DeFi Lending Protocols

To truly understand Scallop’s position as a top contender for the best DeFi lending platform, let’s compare it directly with established protocols across key metrics.

| Feature | Scallop (Sui) | Aave (Multi-chain) | Compound (Ethereum) | Venus (BSC) |

| Transaction Speed | Varies by chain (15s-2min) | ~15 seconds | ~3 seconds | |

| Gas Fees | Very Low ( | Varies by chain ($1-$20) | Medium-High ($5-$15) | Low ($0.10-$0.50) |

| Collateral Options | 10+ (growing) | 30+ | 10+ | 20+ |

| Max LTV Ratio | Up to 85% | Up to 80% | Up to 80% | Up to 80% |

| Flash Loans | Yes | Yes | No | No |

| Governance | DAO with token voting | DAO with token voting | DAO with token voting | DAO with token voting |

This comparison highlights Scallop’s competitive advantages, particularly in transaction speed and gas efficiency due to its Sui blockchain foundation. While newer than some established protocols, Scallop offers comparable or superior features in many key areas, positioning it as a strong contender in the DeFi lending space.

Top 5 Lending Protocols to Watch in 2025

The DeFi lending landscape is constantly evolving, with new innovations and improvements emerging regularly. Here are five lending protocols, including Scallop, that are positioned to make significant impacts in 2025:

1. Scallop (Sui)

Key Strengths: Native Sui integration, low fees, high-speed transactions, competitive collateralization ratios

Innovation Focus: Expanding cross-chain capabilities and introducing under-collateralized lending options through reputation systems

2. Aave (Multi-chain)

Key Strengths: Established reputation, wide asset support, multiple chain deployments

Innovation Focus: GHO stablecoin integration and real-world asset tokenization

3. Compound (Ethereum)

Key Strengths: Battle-tested security, algorithmic interest rates, strong governance

Innovation Focus: Expanding to layer-2 solutions to reduce gas costs

4. MakerDAO (Ethereum)

Key Strengths: DAI stablecoin issuance, diverse collateral types, mature governance

Innovation Focus: Endgame plan for decentralization and real-world asset integration

5. Kava (Multi-chain)

Key Strengths: Cross-chain support, USDX stablecoin, incentivized lending

Innovation Focus: Expanding cross-chain capabilities and institutional partnerships

Why These Matter

These protocols represent different approaches to DeFi lending, from established Ethereum-based platforms to newer, chain-specific innovations like Scallop. Each brings unique strengths to the ecosystem while addressing different user needs.

While established protocols like Aave and Compound continue to dominate in terms of total value locked (TVL), newer platforms like Scallop are gaining momentum by leveraging the advantages of next-generation blockchains and introducing innovative features that address limitations in existing protocols.

Security Measures: Protecting User Assets

Security is paramount for any DeFi lending platform, as users entrust their valuable crypto assets to these protocols. Scallop has implemented comprehensive security measures to protect user funds and ensure protocol stability.

Scallop Security Strengths

- Multiple independent smart contract audits by leading security firms

- Formal verification of critical protocol components

- Gradual TVL caps during initial growth phases

- Bug bounty program with substantial rewards

- Transparent risk parameters and liquidation mechanisms

- Benefits from Sui Move’s inherent security advantages

Security Considerations

- Newer protocol with shorter track record than established platforms

- Sui ecosystem still maturing compared to Ethereum

- Flash loan attack vectors require ongoing vigilance

- Oracle reliability crucial for accurate price feeds

- Governance attacks possible (though mitigated by design)

Scallop’s approach to security demonstrates a deep understanding of DeFi-specific risks and implements best practices from both traditional finance and blockchain security. The use of the Sui Move language provides additional security benefits through its resource-oriented programming model, which helps prevent common smart contract vulnerabilities.

Security Tip: When using any DeFi lending platform, including Scallop, always start with smaller amounts to familiarize yourself with the protocol, maintain healthy collateralization ratios, and regularly monitor your positions to avoid liquidation during market volatility.

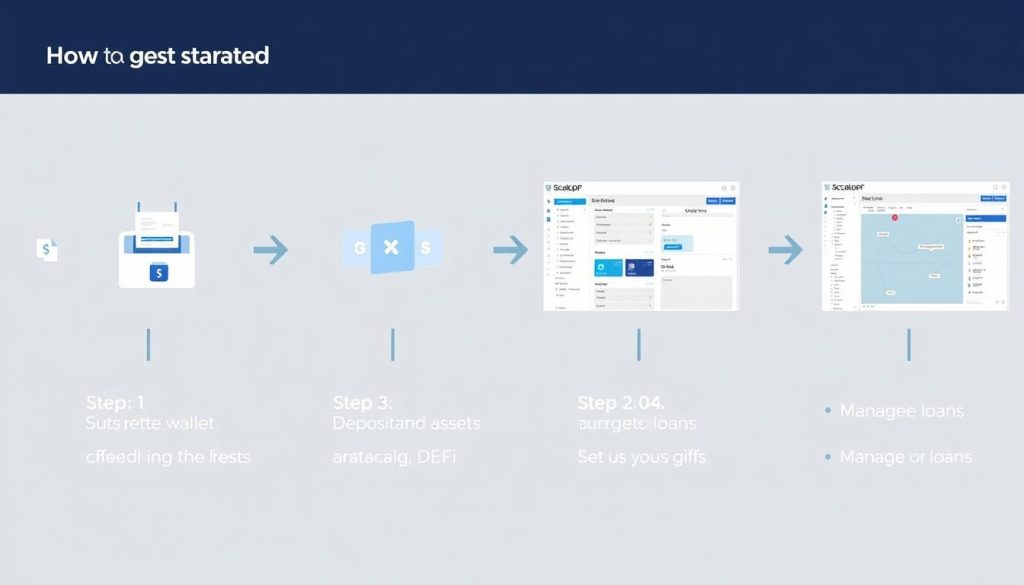

Getting Started with Scallop: A Quick Guide

Ready to experience Scallop’s lending and borrowing capabilities? Here’s a straightforward guide to help you get started with this promising DeFi lending platform.

- Install a Sui-compatible wallet (Sui Wallet, Ethos, etc.)

- Secure your wallet with a strong password and backup phrase

- Add SUI tokens for transaction fees

- Add assets you plan to lend or use as collateral

Step 1: Set Up Your Wallet

- Visit the Scallop app at scallop.io

- Click “Connect Wallet” and select your wallet

- Approve the connection request

- Verify your wallet is connected in the interface

Step 2: Connect to Scallop

- Navigate to the Markets tab

- Select an asset to supply or borrow

- Enter the amount and confirm the transaction

- Monitor your positions in the Dashboard

Step 3: Start Lending or Borrowing

Tips for Maximizing Your Experience

- Start small to familiarize yourself with the platform before committing larger amounts.

- Maintain healthy collateral ratios (at least 200% recommended) to avoid liquidation during market volatility.

- Diversify your collateral across different assets to reduce risk exposure to any single asset.

- Regularly monitor interest rates as they fluctuate based on market conditions and utilization.

- Participate in governance to have a say in protocol parameters and future development.

Ready to Start Your DeFi Lending Journey?

Join thousands of users already benefiting from Scallop’s innovative lending and borrowing solutions on the Sui blockchain.

Future Developments: What’s Next for Scallop

Scallop’s roadmap reveals ambitious plans to expand its capabilities and cement its position as one of the best DeFi lending platforms in the ecosystem. Here’s what users can look forward to in the coming months.

Q2 2024

- Introduction of isolated lending markets

- Support for additional Sui ecosystem tokens

- Enhanced liquidation mechanisms

- Improved analytics dashboard

Q3 2024

- Launch of fixed-rate lending options

- Integration with major Sui DEXs

- Yield optimization strategies

- Mobile app release

Q4 2024 & Beyond

- Cross-chain asset support

- Under-collateralized lending pilot

- Institutional features

- Fiat on/off ramps

These planned developments demonstrate Scallop’s commitment to innovation and addressing user needs. By expanding functionality while maintaining security and usability, Scallop is positioning itself for long-term growth in the competitive DeFi lending space.

“Our vision extends beyond simply offering another lending platform. We’re building a comprehensive DeFi primitive that will serve as a foundation for the broader Sui ecosystem, enabling new financial use cases and bringing DeFi’s benefits to a wider audience.”

Conclusion: Is Scallop the Best DeFi Lending Platform for You?

After a comprehensive analysis of Scallop’s features, performance, and ecosystem integration, it’s clear that this Sui-based protocol is emerging as a strong contender for the title of best DeFi lending platform in 2024, particularly for users prioritizing speed, efficiency, and innovation.

Scallop excels in several key areas that define a top-tier lending protocol:

- Technical Performance: Leveraging Sui’s architecture for faster transactions and lower fees

- Competitive Rates: Offering attractive yields for lenders and reasonable borrowing costs

- Flexible Collateral: Supporting a growing range of assets with favorable collateralization ratios

- Security Focus: Implementing robust security measures and leveraging Sui Move’s safety features

- Ecosystem Integration: Building strategic partnerships within the Sui ecosystem for enhanced utility

However, the “best” platform ultimately depends on your specific needs and preferences. Scallop may be ideal for users who value transaction speed, cost efficiency, and are interested in the Sui ecosystem. Those requiring support for a wider range of assets or with large positions might still prefer more established protocols like Aave or Compound until Scallop further matures.

How to Choose the Right DeFi Lending Platform:

- Assess which assets you plan to lend or use as collateral

- Compare interest rates across platforms for those specific assets

- Consider gas fees and transaction speeds on the underlying blockchain

- Evaluate the platform’s security history and audit status

- Research the team, community, and governance structure

- Start with smaller amounts to test the user experience

As DeFi continues to evolve, protocols like Scallop that build on next-generation blockchains are likely to play an increasingly important role in the lending ecosystem. By addressing limitations of earlier platforms while introducing innovative features, Scallop is helping push the entire industry forward.

Experience the Future of DeFi Lending Today

Join the growing community of users discovering Scallop’s advantages as a leading DeFi lending protocol on the Sui blockchain.

Frequently Asked Questions

What makes Scallop different from other DeFi lending platforms?

Scallop differentiates itself through its native integration with the Sui blockchain, which enables faster transactions and lower fees compared to platforms on more congested networks. It also offers competitive collateralization ratios, a user-friendly interface designed for both beginners and experienced DeFi users, and specialized features optimized for the Sui ecosystem.

Is Scallop safe to use?

Scallop prioritizes security through multiple independent smart contract audits, formal verification of critical components, and leveraging the inherent security advantages of the Sui Move language. While no DeFi protocol is entirely risk-free, Scallop implements industry best practices to protect user funds and maintain protocol stability.

What collateral can I use on Scallop?

Scallop currently supports several assets as collateral, including SUI (Sui’s native token), major stablecoins like USDC and USDT, wrapped versions of major cryptocurrencies (wETH, wBTC), and selected Sui ecosystem tokens. The platform regularly adds support for additional assets based on community governance decisions.

How are interest rates determined on Scallop?

Scallop uses a utilization-based interest rate model that automatically adjusts based on supply and demand dynamics within each lending pool. As pool utilization increases, borrowing rates rise to incentivize more deposits, and when utilization is low, rates decrease to encourage borrowing. This algorithmic approach ensures competitive rates while maintaining liquidity in the protocol.

How can I participate in Scallop governance?

Scallop operates as a DAO (Decentralized Autonomous Organization) where governance token holders can propose and vote on changes to the protocol. To participate, you’ll need to acquire Scallop governance tokens and use them to vote on proposals through the governance portal. Active participation allows you to influence protocol parameters, supported assets, and future development priorities.